About the Crazy Whale

Crazy Whale. Fun name. Serious Token. Period. Crazy Whale is created by a team of highly experienced marketers with 15 years of experience. Previous projects gained 100x in few weeks after creation. Team of Crazy Whale gained 150k+ users for their 2 prevoous bigger projects.

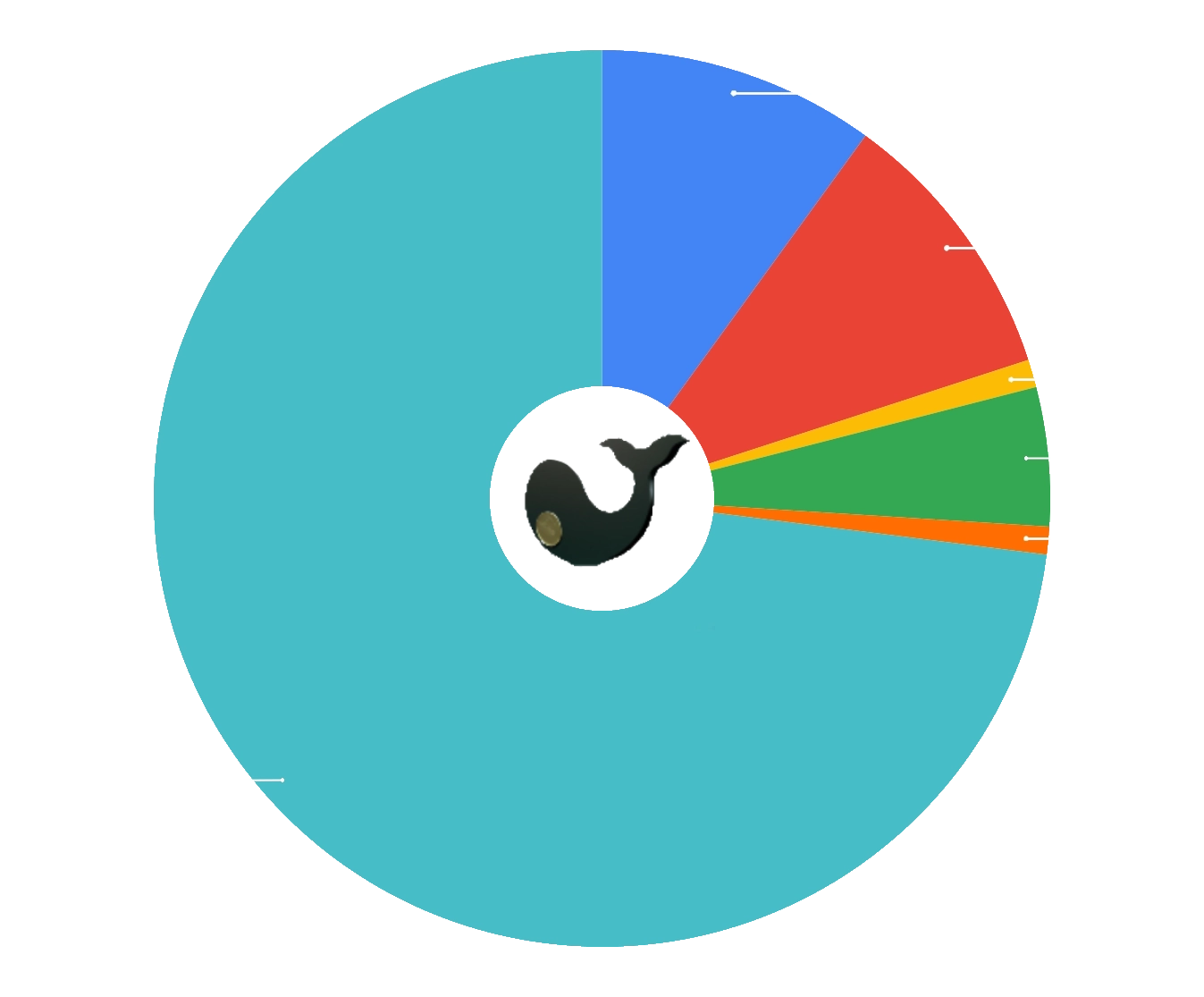

10% of tokens go to marketing. Crazy Whale us the token that real Crypto Whales buy.